Credit Suisse estimates a staggering $1 trillion impact on the world economy as a result of the Russia-Ukraine war.

Today, the world is highly intdependent on each other and every country linked to Russia or Ukraine is looking in the eyes of economic crisis, inflation, currency fluctuations, etc. Several institutional investors, governments and FDI community members have been forced to either exit or reduce business with Russia. With several financial sanctions already placed upon Russia, the European nations with strong business ties with the country are already feeling the tremors in their stock markets.

While Russia and Ukraine are already staring into high inflation, discontinued exports and imports, supply chain disruptions and business suspensions, the global financial system is reeling due to the impact of the war. Some of the key repercussions of the war are:

Increasing current account deficit of several countries

Russia is one of the world’s largest crude oil exporters. With sanctions on Russia, price of crude oil has been moving northwards leaving crude oil dependent countries facing high current account deficit.

Loan loss provisions declined by Large European bank

Most of the loan loss provisions by the European banks have either been declined or reversed. Some of the examples include Lloyds Banking Group PLC, NatWest Group PLC and Barclays PLC. UBS Group and Credit Suisse Group and Danske Bank A/S made writebacks.

Negative impact on the liquidity market

Bank of Russia and its private sector has deployed nearly US$ 300 billion in money markets. With the recent sanctions against Russia, liquidity of the markets will be significantly impacted.

Western Banks exiting from Russia

With the restrictions in operations and sanctions on Russia, almost six large western banks have are in the process of exiting Russia. Since most of these banks have large scale of vested interest in Russia, the banks are trying to look for fastest route to exit keeping the shareholder value intact with limited write-downs.

Unified Global Payments Landscape

Restricting access to US$ 643 billion FOREX and removing Russia from SWIFT led to introduction of Financial Message Transfer System (FMTS) by Russia thereby creating a disparate and disjoint global payments landscape

Boost to Crypto and Digital currencies

In order to circumvent SWIFT restrictions and other economic sanctions, people are increasingly experimenting with cryptocurrencies. Political instability, rising oil prices and increasing inflation are key reasons for loss of confidence in the central bank controlled currencies, thereby, leading to a surge in usage of cryptos such as Bitcoin which is seen as a safer mode to transfer money.

Restricted access of EU’s capital market

Russian banks aren’t allowed to lend or buy any securities from EU entities. Almost 70% of the Russian banks cannot refinance projects in EU leading to a significant cut down of capital access to Russia.

Forex volatility

Dollar has been hitting a high against rouble, however, there has been little impact on Yen owing to least dependence of Japan on Russian economy. Not only this will create multiple exchange rates in certain countries but will lead to a short to mid-term pocket of forex volatility.

Restriction from investing in US

Russian venture capitalists and enterprises are barred from investing into the US. Also, the assets of Russian banks have been frozen to further the sanctions.

Increasing cyber threats

New York Fed has estimated that the five most active US lenders could face cyberattacks impacting more than one-third of its banking assets. Leading to this several banks have increased their cybersecurity awareness, monitoring and training activity.

Talent moving from Russia to Europe

As a result of the war resulting in declining opportunities, both tech and financial talent are moving out of Russia. Firms in Ukraine are allowing their cohorts to move to alternative EU offices resulting in brain drain from both the countries.

Rise in food inflation and commodity prices

Russia and Ukraine account for nearly one-fifth and one-third of the world’s corn market and wheat market respectively. As a result of the war, developed countries are expected to face increase in inflationary pressures while developing or other economies are even expected to face food shortage

Increasing volatility of EU stock markets

EU stock markets such as UK, Germany and France have moderate level of correlation with Russian stock market. With weakening financial condition of the Russian stock market, EU stock market are showing signs of volatility.

Russia-Ukraine crisis is expected to slow down the global growth and raise inflation across the globe. With sanctions from the US, EU, Japan, Australia and several other countries, economic shockwaves are being felt by financial systems worldwide. Already, the global economy was gasping for air due to COVID for past two years, a highly volatile time awaits for the global economy and financial centres in mid-term.

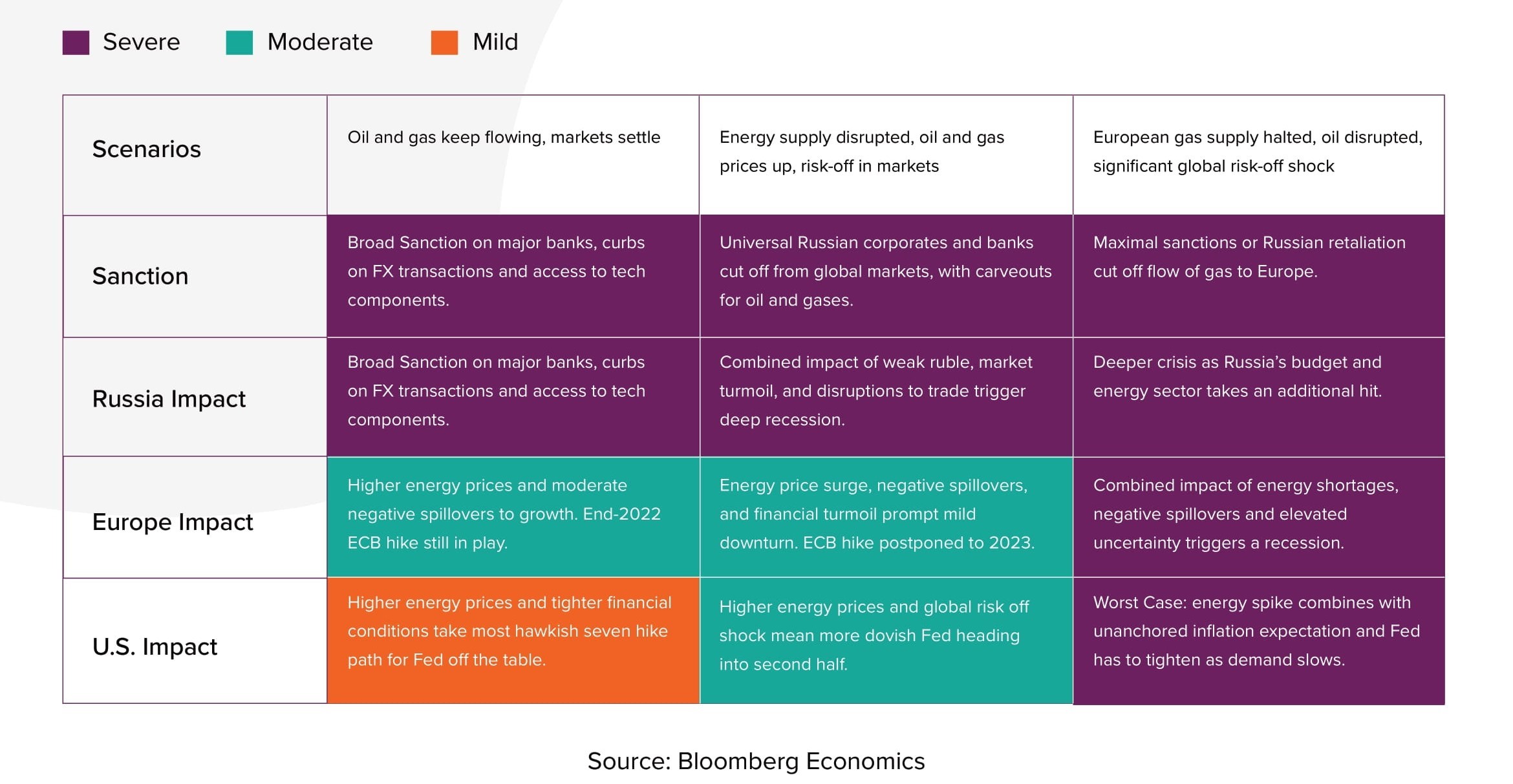

Scenarios For Economic Impact of Ukraine Crisis

Possible paths for the Russian, European and U.S. economies

References:

Global Supply Chains Face Disruption Following Russia's Invasion of Ukraine

Russia-Ukraine War Has Hit Currencies Hard

Russia-Ukraine War: Assessing Accounting Impacts

Russia-Ukraine Crisis Market Impact

Impact of Ukraine Crisis on Global Financial Sector (No Link Provided)

How is the Russia-Ukraine War Impacting the Financial and Tech Sectors?

How the Russia-Ukraine War is Affecting the Global Financial Market

Russia-Ukraine War and the Financial World

Global Economic Impact of Russian Invasion of Ukraine

EY, Deloitte Join PwC and KPMT in Ceasing Russian Operations

How the Ukraine-Russia Conflict Could Impact the Global Economy

The Financial System Consequences of the Russia-Ukraine War

Impact on Financial and Tech Sectors by Russia-Ukraine War

War in Ukraine: Implications for Financial Services

How Russia's War in Ukraine Affects the Financial Sector

Big European Banks Unlikely to Book Russia-Ukraine War Provisions in Near Term