This article is the first in a series on ESG and the SustainX solution.

A long-term cost-benefit view, supported by solutions like SustainX, can make you an ESG champion

The threat to the environment is evident now, and it can no longer be brushed under the carpet. For global businesses, being conscious of ESG – Environmental, Social, and Governance – factors is essential for attaining long-term growth. ESG also forms a deciding factor for investors, clients, and suppliers.

Businesses are realizing this fact and have considerably increased their investment in ESG initiatives. According to a study by Everest Group, there has been a 30% rise in sustainability investment among service providers from 2021 to 2022. These players used both organic and inorganic means to enhance their ESG capabilities.

The Business Impact of Becoming Sustainable

Business objectives and ESG

There can be a multitude of business objectives that are related to ESG compliance and capabilities. When considering or planning investments in sustainability, these objectives should be considered as the guiding principles. The high-level business objectives can be:

- Achieve net zero targets: Every organization sets its net zero targets based on its current condition, rate of carbon emissions, and key operating models. Working toward net zero targets will necessitate investment in organizational sustainability.

- Introduce sustainability in operations: The next goal is to make all operations as sustainable as possible. To simplify, all operations must reduce the carbon footprint by consuming less electricity and water, minimizing waste, and recycling resources.

- Maximize the productivity of resources: While inputs of resources should be monitored and controlled, outputs from all operations must be increased. This will ensure that all raw material is used in the best possible way, and resources are channelized to maximize productivity.

- Improve retention rate and hiring: The objective of leadership should be to make ESG investments in such a way that helps to boost retention rate, and result in better hiring outcomes. Attracting and retaining skilled talent will help an organization in many ways.

Now that we know the business objectives directly related to ESG and investment in sustainability, we can map the impacts of such goals on business. These impacts can again be broadly categorized as strategic and operational. Here are the key metrics that denote the business impact:

| Operational metrics | Strategic metrics |

| Accurate and timely reporting | Higher ESG alignment with external stakeholders |

| Improved ROI and reduced cost of capital | Rise in brand presence and awareness |

| Reduction in expense on energy and utilities | Better employee engagement and retention |

| Lower travel expenses and fuel consumption | Lower regulatory risks with better compliance |

| Lean processes resulting in lower waste disposal | Generate ownership within internal stakeholders |

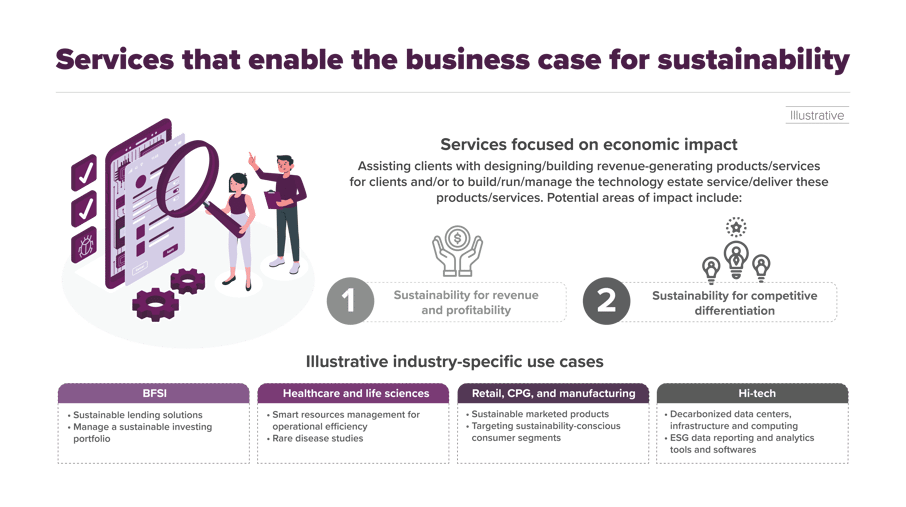

Environmental issues will eventually affect productivity and profits. A survey by Everest Group shows industry-specific use cases for sustainability measures, proving a clear correlation between ESG and business growth. Hence, companies are taking steps to support margins. Banks, for instance, are forming policies that account for natural hazards that may damage clients' businesses or increase debt risks. There are several other industries for which the ESG use cases have operational and strategic benefits.

Some of the primary investments in organizational sustainability that we can move towards are:

- Creating and marketing products and services that are sustainable.

- Tracking and controlling the carbon footprint within various functions.

- Increased awareness amongst consumers, partners, and suppliers about tracking carbon emissions.

- Adopting tools and systems that support ESG analytics and reporting.

Here's an illustration explaining the benefits some businesses reap using the sustainability lens.

Source: Everest Group Report

Analyzing the benefits

There are considerable benefits to investing in a strong ESG policy. Investors screen the ESG efficiency of a business before putting in their money. Prospective employees also check the practices and policies of a company when they consider joining it. While some investment is required to attain long-term results, the returns are palpable, especially through decarbonization and waste reduction.

Direct measure

The following metrics demonstrate the direct impact, which reflect strategic and operational paradigms:

| Better ESG practices = high retention rate + higher productivity + lower operation costs |

- Higher retention: Good ESG practices directly result in better employee engagement, people welfare, and safety. This will, in turn, translate to better productivity, happier employees, and lower attrition rates.

- Low cost of capital: Even when a business acquires credit, interest rates are lower if sensible ESG practices are implemented. From a taxation point of view, there are several benefits for companies that follow good governance policies.

- Greater efficiency: Through such policies, businesses can improve energy efficiency, reduce deforestation, emission of greenhouse gases and water consumption, and reuse plastic. A company's bottom line is bound to improve by adopting Lean practices and reducing waste.

Indirect measure

Some results may not be visible in terms of direct profits but will bring gains to a company in a macroeconomic sense.

| Strong ESG policies = higher shareholder value + credit ratings + CSAT |

- Brand awareness: When people learn about more conscious environmental policies and practices, customers will create a positive image of the company, thus improving the value of goodwill. This will drive lenders to offer better lending rates for capital investments.

- Higher valuation: The customer satisfaction scores and the shareholders’ confidence in the company will grow. The value of shares is sure to go up in the long run. This will attract investors and partners, as well as prospective clients.

Challenges to Investing in Sustainability

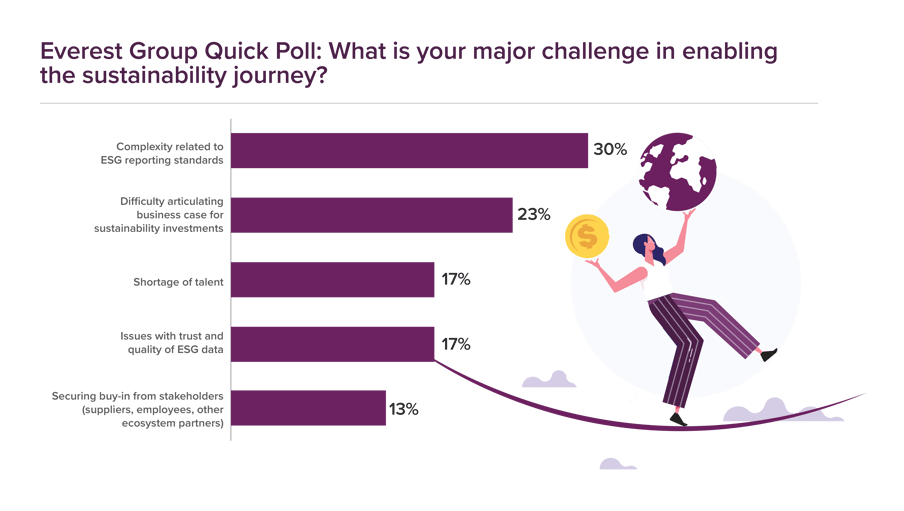

Despite all the benefits of formulating a strong ESG policy and stringently implementing it, certain blockers make it difficult for companies to meet the goals. The challenges can be related to measurement and analysis, as well as stakeholder-related. Here are some aspects that cause considerable impediments:

- Lack of transparency in reporting: There are several levels of tracking and reporting of ESG data within various functional units of a company. When consolidating all the data, some of the information can be lost or needs to be clarified.

- Incomplete or inconsistent data: There is a risk of incomplete data not presenting an accurate picture of ESG compliance. This can happen if the people responsible for reporting are unaware of the latest tools and standards or if some units are unwilling to provide accurate information.

- Shortage of skilled people: While ESG compliance is an absolute necessity, there is a need for more talent that fits the green role, as it is a new and evolving function. Specialized skills are required for sustainability reporting and ESG leadership, and companies are looking for people with multidisciplinary expertise in climate, technology, projects, and stakeholder management. But all hope is not lost. As per a survey conducted by Salesforce, though there is a need for more talent, adequate training and investment in upskilling should be able to prepare the existing employees for taking up ESG roles.

- Complexity in standards: Since there are different measurement and reporting standards for environmental and governance effectiveness, the reporting lacks transparency and accuracy. Especially for organizations that operate globally, it is essential to ensure proper reporting and analysis methods are being used.

- Inaccurate analysis: In some cases, the tracking and reporting might be correct, but the analysis can be faulty if the company still needs to adopt updated tools and software for ESG analysis. Cloud-based platforms and AI-powered analytics are advisable for improving the analysis that leads to crucial ESG decisions and process formulation.

- Allocation of costs: When all is said and done, if a company does not consider ESG compliance a priority, the cost allocation will be a problem. Updating the systems, analyzing data, maintaining machinery, and reducing carbon emissions involve considerable costs. So, cost allocation should be made after understanding the business processes.

- Relating sustainability investment with business goals: This is related to cost allocation. Firstly, the leadership must be very clear about the need to invest in sustainability, and they should tie up these with the overall organizational goals. Secondly, investors, and sometimes shareholders, must understand how these investments will help to achieve the objectives.

- Stakeholder management: Even if all the parameters within the organization are met, the lack of support from stakeholders can hamper the ESG goals. Raising awareness and ensuring that partners and suppliers follow green norms is tough, but it can become a turning point for companies.

A poll by Everest Group highlights some challenges companies face in enabling the sustainability journey.

Source: Everest Group Poll

Creating the Sustainability Roadmap

Despite the challenges, business needs and ecological conditions make it imperative to strengthen the ESG structure. Incorporating these steps into the overall policies and procedures will help to build a clear roadmap.

- Building cross-functional teams

- Considering ESG objectives for business decisions

- Developing metrics for business processes impacting ESG

- Planning operations to boost ESG implementation

- Effective ESG reporting

- Involving stakeholders – suppliers, employees – in ensuring best practices

With transparent measurement, timely corrective action can be taken. Hence, it is crucial to choose a technology partner that makes it easier to accomplish the above targets.

Investing with a Purpose

The international community is vigilant and conscious about creating frameworks that can guide corporate decision-making regarding ESG. The IFRS Foundation also announced the creation of the International Sustainability Standards Board (ISSB). In January 2023, the European Commission (EC) adopted a proposal for a Corporate Sustainability Reporting Directive (CSRD). These directives will help to overcome the challenges and promote the enablement of effective ESG action.

As per Everest Group’s Purpose Maturity Framework, the following factors will help companies identify the areas of investment to become purpose-driven:

- Objective – Build and offer sustainability-focused products and services

- Drivers – Growth and expansion of product and services portfolio

- Measurement – Revenue generated and new products launched

- Commitments – Enabling clients to achieve quantifiable, time-bound commitments through focused offerings

- Disclosures – Integrated reporting with impact description of outcomes in terms of consumers impacted and revenue generated

- Ecosystem – Collaborate to serve consumers’ sustainability needs better

- Governance – Client disclosures and contractual obligations

- Data and technology – Self-service, cognitive tools, and dashboards

SustainX – A reliable partner for sustainable development

The Everest Group report also said that Cloud will be the next key technology driving sustainability enablement through unified data intelligence and empowering sustainable IT infrastructure. Xebia’s ESG solution built on the Salesforce NetZero Cloud platform is an apt choice for companies aiming to set up a robust sustainability framework.

SustainX provides a 360-degree ESG solution for your sustainability and business requirements. The tools and technologies can help any organization integrate the solution into their existing enterprise technology stack and scale up. The AI tools are built in-house and lead to a significant reduction in costs and Go-Live milestones. Our strengths include:

- AI-based automation and data management

- Tracking scope 1, 2, and 3 emissions

- Accurate analysis using SF Einstein

- Creating sustainability workflow

- Reporting through an interactive dashboard

Our region-specific out-of-the-box reporting customizations help you mitigate regulatory risks by giving ready-to-download real-time reports and sharing meaningful, actionable intelligence with all the relevant stakeholders and clients. Stay tuned for the next article in this series to get a deeper region-wise perspective on the ESG reporting regulations.

If you'd like to learn more about our SustainX solution, get in touch with us!